Mar 27, 2025

- Corporate

Notice of Disposal of Treasury Shares as Restricted Stock Compensation Plan

| Name of listed company: | Chugai Pharmaceutical Co., Ltd. |

| Code number: | 4519 (Prime Market of Tokyo Stock Exchange) |

| Head office: | 1-1, Nihonbashi-Muromachi 2-Chome, Chuo-ku, Tokyo |

| President & CEO: | Osamu Okuda |

| Inquiries to: | Kae Miyata |

| Head of Corporate Communications Dept. | |

| Tel:+81-(0)3-3273-0554 |

Chugai Pharmaceutical Co., Ltd. (the “Company”) hereby announces that, at the meeting of its Board of Directors held on March 27, 2025, the Directors decided to dispose treasury shares (the “Disposal of Treasury Shares” or the “Disposal”) as follows.

1. Outline of the Disposal

| (1) | Disposal date | April 25, 2025 | |||||||||||||||

| (2) | Class and number of shares to be disposed | 82,000* shares of Common stock of the Company | |||||||||||||||

| (3) | Disposal price | ¥7,091 per share | |||||||||||||||

| (4) | Total value of shares to be disposed | ¥581,462,000* | |||||||||||||||

| (5) | Allottees and number thereof, number of shares to be disposed |

|

|||||||||||||||

| (6) | Others | With respect to the Disposal of Treasury Shares, the Extraordinary Report set forth in the Japanese Financial Instruments and Exchange Act is to be submitted. |

2. Purposes and Reasons of the Disposal

At the meeting of its Board of Directors held on February 1, 2017, for the purpose of further promoting shared value with shareholders and providing an incentive for the Company’s Executive Directors (excluding non-executive Directors, the “Eligible Directors”) as well as Vice Presidents and Employees (the “Eligible Vice Presidents etc.” collectively, the “Eligible Directors etc.” with the “Eligible Directors”) to sustainably increase the Company’s corporate value, strengthening linkage between their compensation and mid- to long-term business performance, the Directors decided to introduce a restricted stock compensation plan (the “Compensation Plan”) , and at the 106th Annual General Meeting of Shareholders on March 23rd, 2017 (the “General Meeting of Shareholders”), based on the Compensation Plan, as the monetary compensation to serve as invested assets to acquire the restricted stocks (the Restricted Stock Compensation), it was approved that the amount of the Restricted Stock Compensation for the Eligible Directors shall not exceed 345 million yen, and that the restricted period on stock transfer shall be decided by its Board of Directors from three (3) years to five (5) years.

The Company resolved at a meeting of its Board of Directors held today to grant the same restricted stock compensation to directors and employees of the Company’s subsidiaries (hereinafter referred to as “subsidiary directors, etc.” and collectively with the Eligible Directors and Eligible Vice Presidents etc., referred to as “Eligible Directors, etc.”). This disposition of treasury stock is to be implemented for the Eligible Directors, etc. as part of this plan.

[Outline of the Plan]

Under the Compensation Plan, the restricted stocks to be provided consist of the “tenure-based restricted stock” for the Eligible Directors etc., which requires continuous service for a certain period as Eligible Directors etc., and the “performance-based restricted stock” for the Eligible Directors which requires the attainment of the Company’s mid- to long-term business performance target on top of the aforementioned continuous service.

The Eligible Directors etc., shall make in–kind contribution of all monetary compensation claims or monetary claims to be provided by the Company or the subsidiaries according to the Compensation Plan, and shall, in return, receive shares of common stock of the Company that shall be issued or disposed by the Company. The total number of shares of common stock of the Company to be issued or disposed for the Eligible Directors shall not exceed 165,000 shares (495,000 shares due to stock split effective July 1st, 2020) per year, and the amount to be paid per share shall be the closing price of common stock of the Company on the Tokyo Stock Exchange on the business day immediately preceding the date of the resolution by the Board of Directors (or the closing price on the transaction day immediately prior thereto if no transaction is made on such business day.).

For the issuance or disposal of shares of common stock of the Company under the Compensation Plan, the Company and each Eligible Directors etc., shall make an agreement on allotment of restricted stocks (the “Allotment Agreement”), which includes (1) The Eligible Directors etc., shall not transfer, create a security interest on, or otherwise dispose of the shares during a certain restriction period, and (2) The Company shall take back all or part of the shares without cost in case where certain events happen.

Considering the purpose of the Plan, responsibility of the Eligible Directors etc., and levels of compensations for directors and executives officers in the Japanese pharmaceutical industry, the Company has decided to provide the total sum of the monetary compensation claims and monetary claims of ¥581,462,000*, and 82,000* shares of common stock of the Company, in order to promote competent people as executive officers and to further increase motivation of the Eligible Directors etc. For the Disposal of Treasury Shares, 130 of the Eligible Directors etc., shall make in–kind contribution of all monetary compensation claims or monetary claims to the Company according to the Compensation Plan, and shall receive disposed shares of common stock of the Company.

3. Overview of the Allotment Agreement

| (1) |

Transfer restriction period: April 25, 2025 -April 30, 2028 |

||||||||

| (2) |

Conditions for releasing transfer restriction for “tenure-based restricted stock” |

||||||||

| (3) |

Conditions for releasing transfer restriction for “performance-based restricted stock” TSR calculation formula:

A: Initial stock price (Average closing price for the three months prior to the start of the Evaluation Period) |

||||||||

| (4) |

Treatment in cases the Eligible Directors etc., retire or resign from its position due to expiration of the term of office, reaching retirement age, death, the inability to perform the duties resulting from illness or injury, or other due cause approved by Chugai’s Board. (I) Time of release

(II) Number of shares subject to release

|

||||||||

| (5) |

Take-back without cost by the Company |

||||||||

| (6) |

Control of stocks |

||||||||

| (7) | Treatment during reorganization, etc. If, during the transfer restriction period, matters relating to a merger agreement in which the Company is the dissolving company, a share exchange agreement or share transfer plan in which the Company becomes a wholly owned subsidiary, or other reorganization are approved at the Company’s General Meeting of Shareholders (or in the case where the approval at the Company’s General Meeting of Shareholders is not required, in relation to the reorganization in question, a meeting of its Board of Directors), based on the resolution of the Board of Directors, the number of shares that is reasonably calculated considering the number of months from the beginning of the transfer restriction period to the month including the approval day of the reorganization shall be released prior to the date the reorganization becomes effective. |

4. Basis of Calculation and Specific Details for the Payment Amount

The Disposal of Treasury Shares to the Eligible Directors etc., shall be funded by monetary compensation claims or monetary claims which the Company and the subsidiaries provided as the Restricted Stock Compensation for 2025 in accordance with the Compensation Plan. To eliminate arbitrariness in the disposal price, the closing price for the common shares of the Company on the First Section of the Tokyo Stock Exchange on March 26, 2025 (the business day prior to the day of resolution at the meeting of the Board of Directors) of ¥7,091 is used as the disposal price. As this is the market price the day prior to the day of resolution of the Board of Directors, we believe it is valid and does not represent a particularly favorable price.

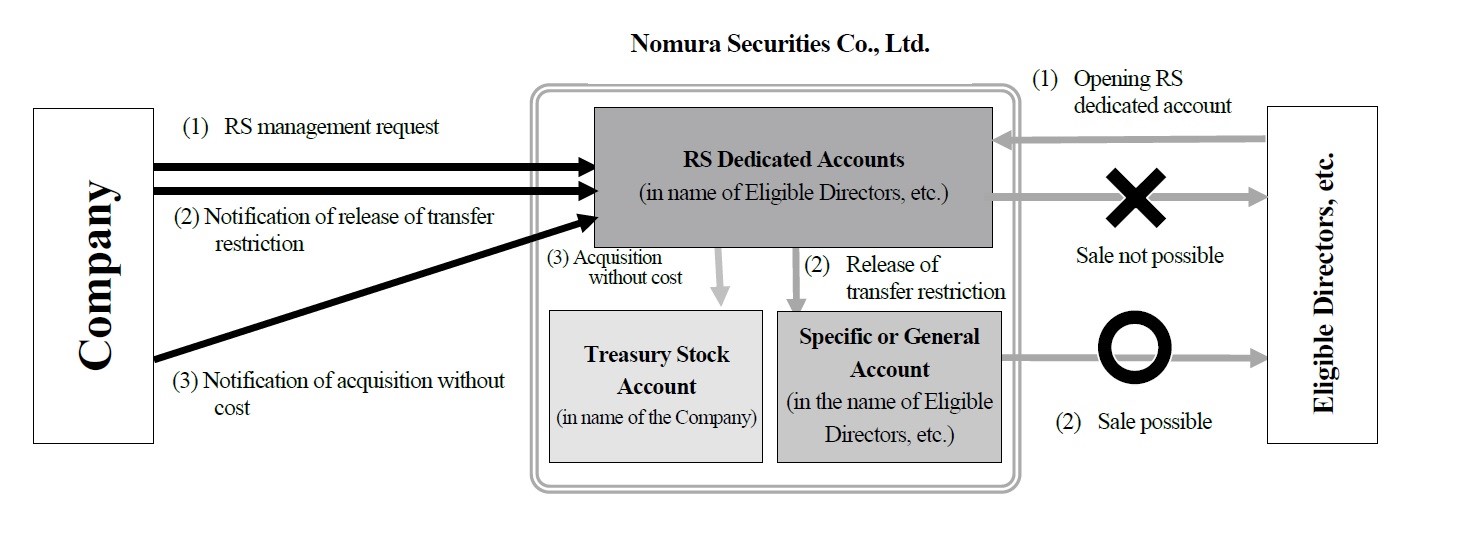

(Reference) [Restricted Stock (RS) Management Flow in the Restricted Stock Plan]

* In the announcement released on March 27, 2025, there were corrections in the numerical values of total sum of monetary compensation claims and monetary claims and number of shares of common stock granted this time in “ (2) Class and number of shares to be disposed ” and “(4) Total value of shares to be disposed ” described in “1. Outline of the Disposal”, and “2. Purposes and Reasons of the Disposal”. The data have been corrected and replaced with data that reflect the correct values. (The corrections were registered on the TSE as of April 22, 2025.)

Contact:

- For Media

- Chugai Pharmaceutical Co., Ltd.

- Media Relations Group, Corporate Communications Dept.,

- Hideki Sato

- Tel: +81-3-3273-0881

- E-mail: pr@chugai-pharm.co.jp

- For Investors

- Chugai Pharmaceutical Co., Ltd.

- Investor Relations Group, Corporate Communications Dept.,

- Takayuki Sakurai

- Tel: +81-3-3273-0554

- E-mail: ir@chugai-pharm.co.jp